NOT ANOTHER NICKEL, NOT ANOTHER DIME: How Harvard Financially Supports Israeli Occupation

Harvard’s endowment seems a black box of colossal proportion. It is nearly $50 billion worth of opaque investments and undisclosed financial ties. In conversations with student activists, Harvard administration acts as a proxy for the Harvard Management Company, dismissing demands for disclosure and divestment with retorts of “infeasibility.”

Harvard’s financial dealings were somewhat more transparent before the 2008 financial crash. HMC used to rely more heavily on direct investments into securities that were traded – and, thus, viewed – publicly. Post-2008, HMC restructured their investment model, shifting investments from public to secretive private equity and hedge fund vehicles, a move that has, in part, made the endowment the concealed and contested entity that it is today.

What information we do have about most of Harvard’s current holdings shows nondescript firms in tax havens like Delaware and the Cayman Islands, which further conceal financial decisions behind another set of confidentiality agreements.

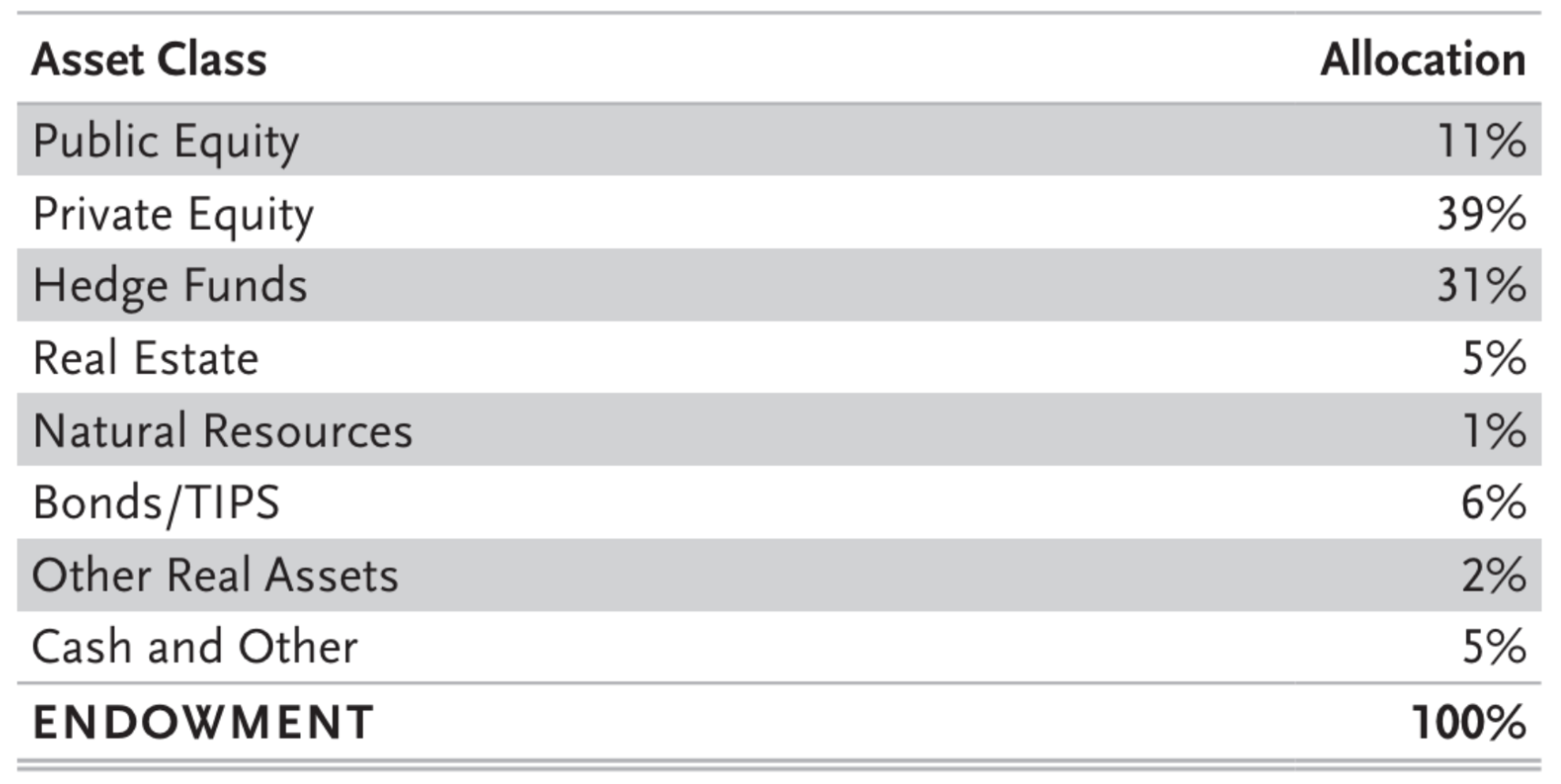

The Chief Executive Officer of HMC released these classifications of endowment assets:

Among the 11% of the endowment in public equity, which refers to publicly traded stocks, only 3% consists of direct investments by the HMC – that is, investments that must be publicly disclosed on Harvard’s own financial filings. This 3% – $1.5 billion in its own right – serves as a partial window into Harvard’s financial abyss.

By investigating how Harvard chooses to invest in direct investments that it knows are subject to public scrutiny, we can form reasoned approximations as to where money is flowing outside of our view. And still, these would only be “best guesses.” As pro-Palestine activists and the HOOP coalition have reiterated time and time again, Harvard itself can and must disclose all investments in Israel and its occupation of Palestine.

We can take, for example, one of the largest recipients of Harvard’s direct public investments – Google. As of November 2023, Harvard’s holdings in Alphabet Inc. (GOOGL) total more than $227 million. In 2021, Google signed a contract to assist in Israel’s Project Nimbus, a cloud computing project and artificial intelligence project for the Israeli government and military.

Harvard also has $21,875,000 in direct public investment in the chipmaker and trillion-dollar-tech company NVDA/NVIDIA. NVIDIA partners with Siemens, a corporation placed on the BDS list for enabling “illegal settlements on stolen Palestinian land to benefit from Israel-EU trade of electricity produced from fossil gas.” In May 2023, NVIDIA announced that it would invest millions in developing an AI supercomputer for the Israeli government, and their CEO reaffirmed this March that NVIDIA has no plans to halt its investments in Israel. Harvard publicly invests tens of millions in a corporation that will stop at nothing — not even the most well-documented genocide of the modern age — in pursuit of profit.

Furthermore, the AI Google and NVIDIA provide is a weapon of mass destruction in the hands of the Israeli Occupation Forces. AI allows Israel to collect data on and surveil Palestinians more closely than ever before. Using Google Photos, the IOF has instituted systems of facial recognition which restrict Palestinians’ movement across checkpoints, like those of the West Bank. Most recently, technologies developed by companies like Google and NVIDIA have enabled Israel’s deployment of AI systems like Lavender AI and “the Gospel” that automate ongoing bombings in Gaza.

Google and NVIDIA are just two examples of Harvard’s investments in – and profiting from – not just the rigid surveillance of Palestinian lives but the routinization of mass Palestinian death in this ongoing genocide.

These two companies are just the start of fathoming just how deep Harvard’s ties to Israeli occupation and settler violence run. Due to the opaqueness of Harvard’s investments that convolute their ties to bloodshed, calls for transparency through endowment disclosure are more important now than ever. Once we have a fuller account of Harvard’s investments, we demand that HMC immediately divest.

There is significant precedent at Harvard for divesting as a result of societal harms and human rights abuses. Harvard’s “Sustainable Investing Policy” stresses that the HMC “is committed to considering environmental, social, and governance (ESG) factors in the course of underwriting, analyzing, and monitoring investments.” Such commitment was applied to the tobacco industry in 1990, when Harvard justified divesting as a result of the industry’s “substantial and unjustified risk of harm to human health.” In 2005, Harvard divested from the oil industry in Sudan, selling its shares of PetroChina, as a result of its close association to the Sudanese government, which had “been found to be complicit in…‘genocide’ in Darfur.”

After years of protests, including the 1986 construction of a mock shantytown in Harvard Yard, Harvard carried out a “selective divestment” from South Africa, kickstarting a broader wave of divestment from South Africa that contributed to the end of apartheid. There is ample precedent for Harvard to divest from companies and countries perpetrating human rights abuses – and yet Interim President Garber considers divestment an idea he “will not entertain.” In disclosing and divesting, Harvard would mark a turning point, relocating itself on the side of Palestinian liberation.